Frustrated with Health

Insurance?

Same.

We help self-employed professionals find better healthcare memberships without the insurance headaches.

Frustrated with Health Insurance?

Same.

That’s why we created indipop, a marketplace for better healthcare options.

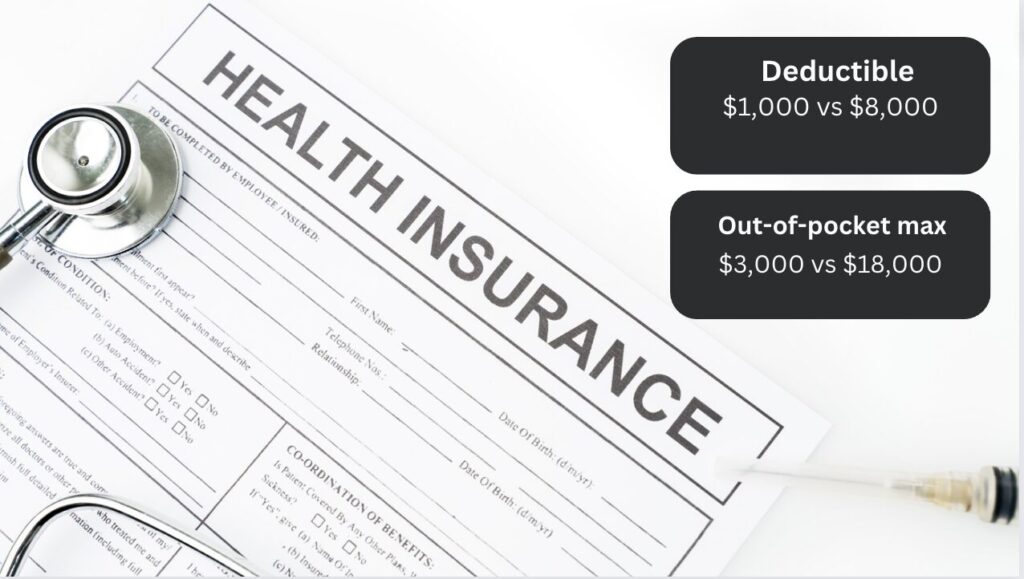

Think your health insurance is giving you the best deal? See how it stacks up against a healthcare membership

Compare traditional insurance with healthcare membership alternatives and get personalized cost estimates straight to your inbox.

Independent by Nature. Supported by indipop.

indipop is a marketplace featuring curated healthcare memberships

Built for freelancers, consultants, creatives, and entrepreneurs who need flexible, affordable care options. Each membership is carefully selected for quality, transparency, and real-world value.

The American healthcare system wasn’t built for independent professionals it was built for large employers and profits. If you’ve ever felt overwhelmed trying to find healthcare on your own, you’re not alone. indipop makes it simple, offering concierge support and personalized guidance every step of the way.

One size doesn’t fit all.

That’s why our marketplace includes a range of healthcare memberships tailored to how you use healthcare.

We believe in radical transparency and helping you find the right fit – even if that means pointing you to a solution outside of indipop.

You deserve great healthcare.

Approximately 55% of Americans have incurred medical debt. Health insurance is complex, complexity is expensive. indipop options take out the middle man to bring you lower rates.

Why

indipop?

indipop is more than just a platform— we are a value driven company dedicated to revolutionizing

healthcare in the U.S. and easing the burden for those who don’t fit the traditional insurance model.

What We Provide:

Unbiased support

Expert guidance

Competitive rates

Personalized comparison tools

Ongoing resources and advocacy

The indipop Impact

Features Our Members Love

HSA-Compatibility for tax savings

Access to functional medicine

Direct Primary Care (DPC)

Robust benefits for every day care

Solutions for high cost medical

Low-cost labs and imaging services

Need help? Use our free matching service or speak with a Health Guide to find the right fit for you, your family, or your team.

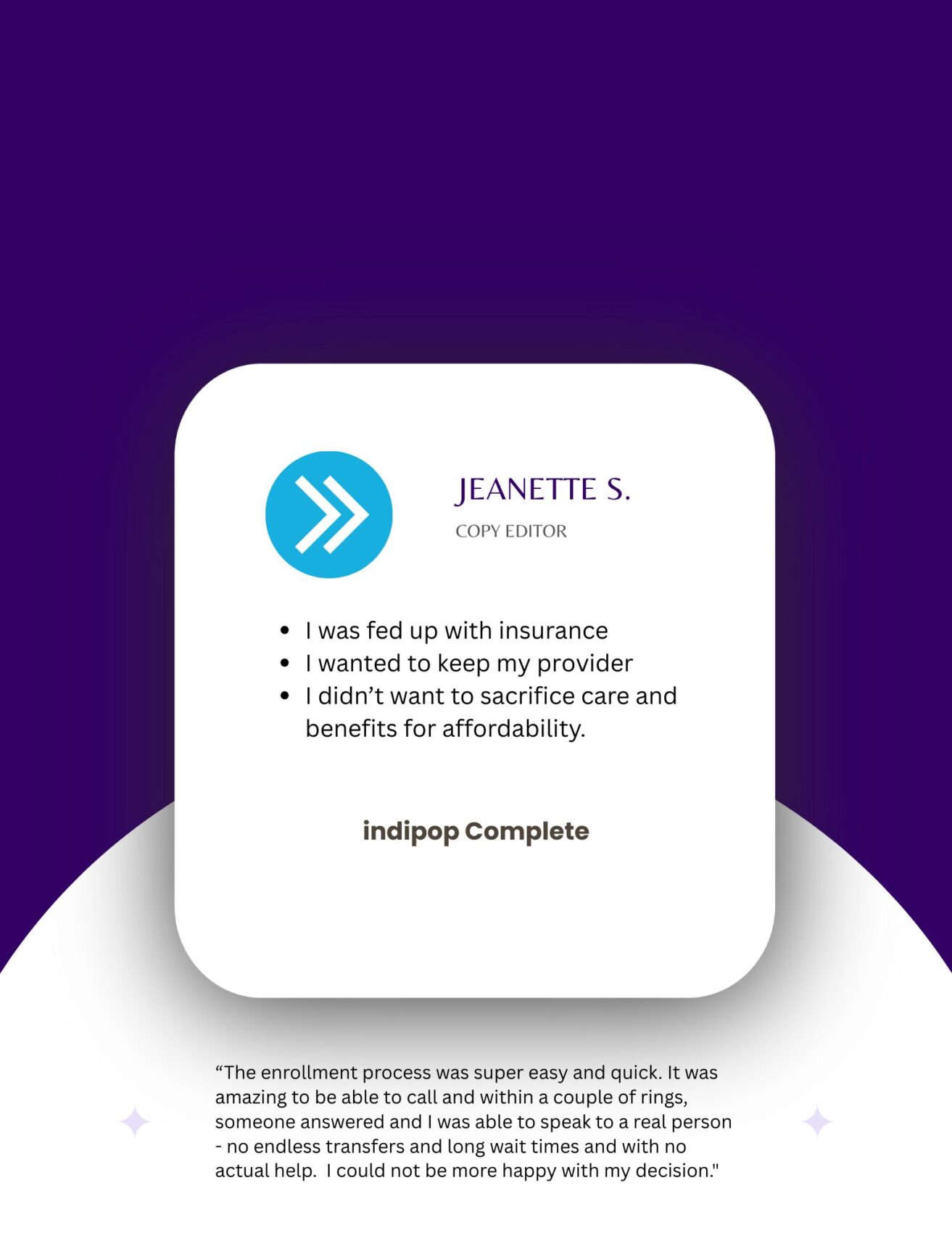

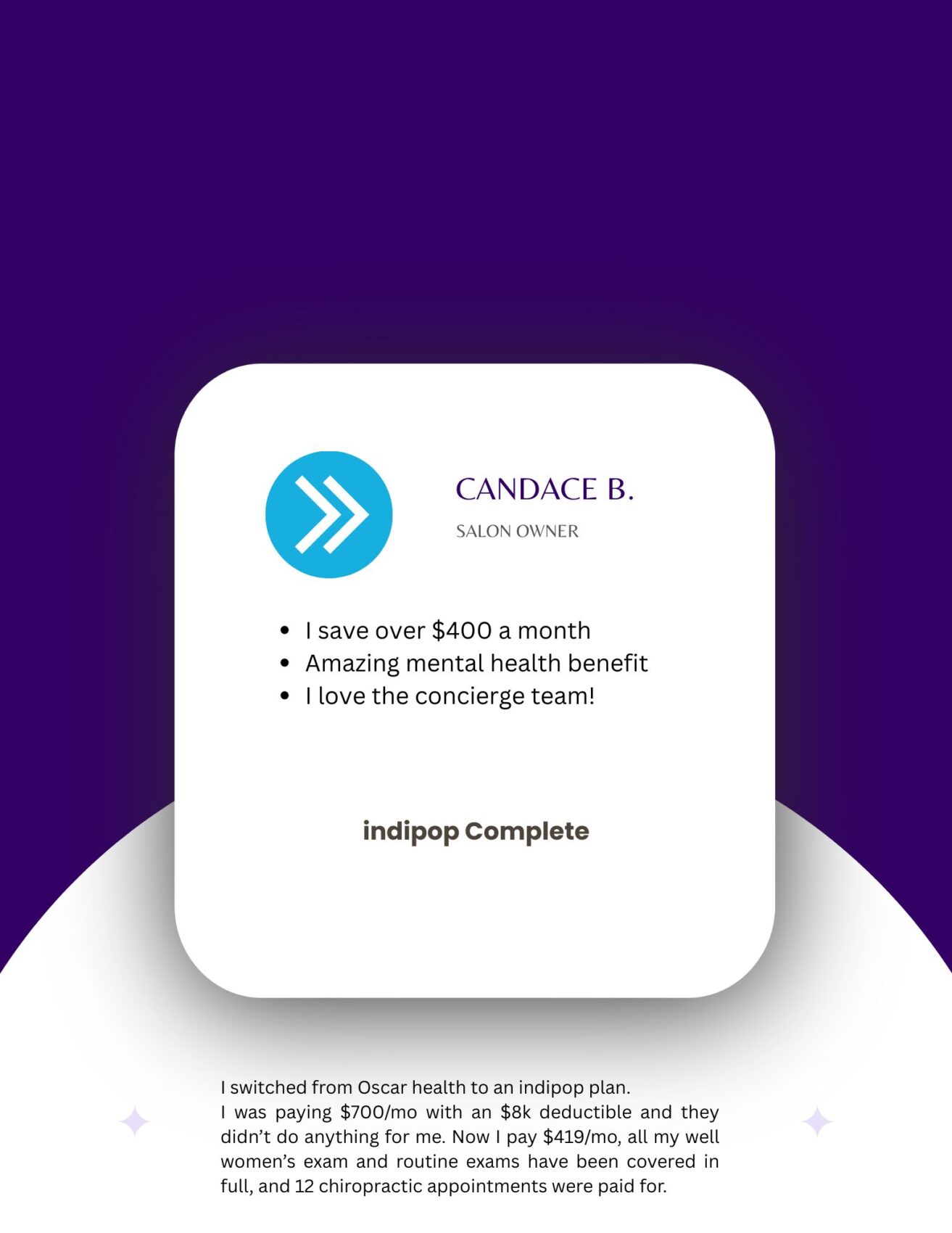

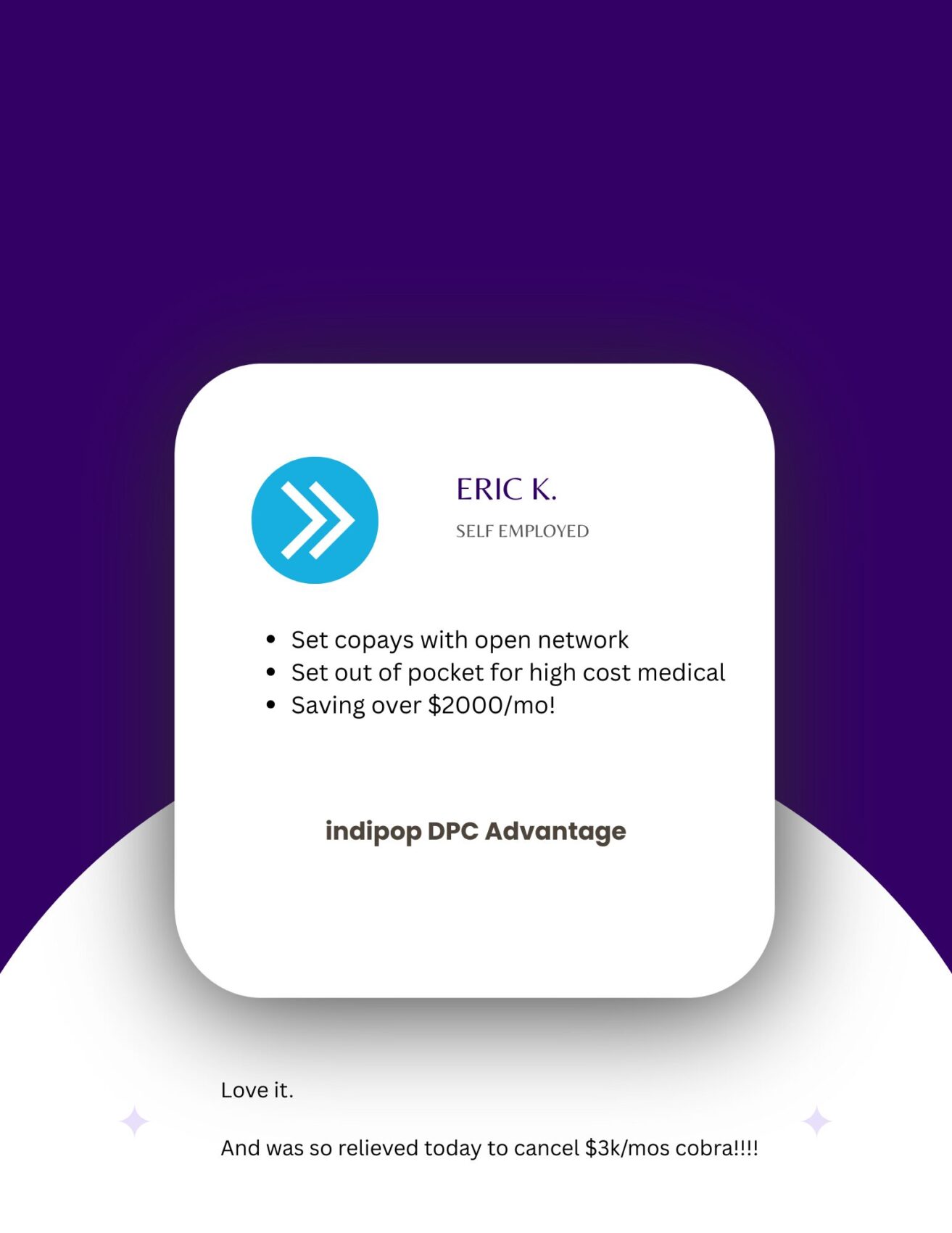

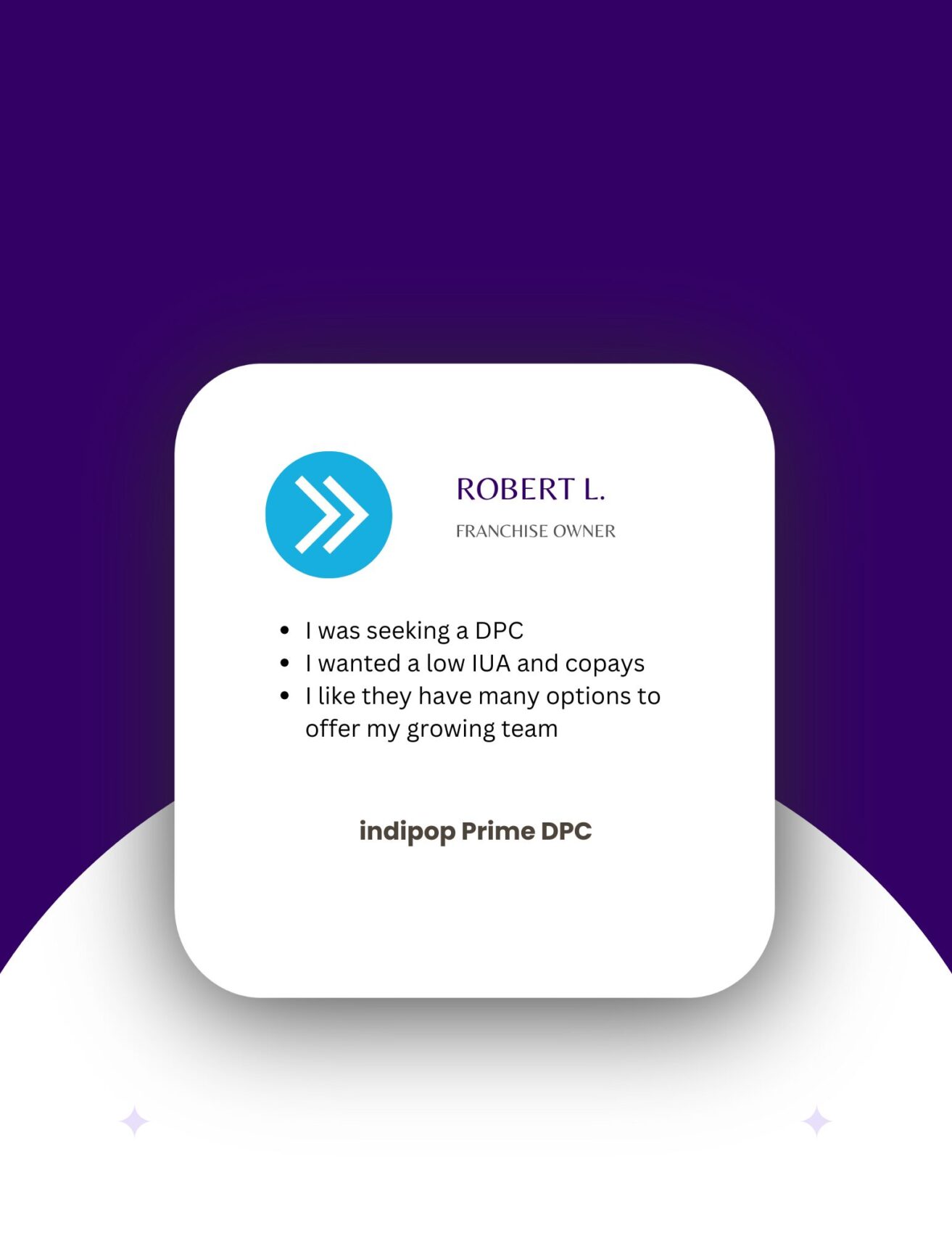

See Why People Love indipop

Your Healthcare, Your Way—With Freedom, Flexibility, and Unmatched Support

"Would strongly recommend for anyone looking for a healthcare alternative"

They are much more helpful and easy to communicate with than any government healthcare service. Shoutout to Sierra for all your help!

Ravi

NY

"It’s the best financial and health move I have made ever"

With indipop’s help I switched from insurance to a healthshare and it’s the best financial and health move I have made ever. I only wish I knew about healthshares sooner. Thank you Melissa!

Amy B.

Self Employed | California

"The relief I feel is astounding"

I wanted to thank you from the bottom of my heart for the work that you do. I cannot express how stressed I have been about what I would do for health insurance once my COBRA coverage ended and the relief I feel is astounding.

Molly J.

Self Employed | New York

"I highly recommend this 'best kept secret'!"

Everyone suffers from the high costs of medical insurance and fighting for reimbursements if you go out of network.

Melissa discovered an alternative known by few and she did extensive research to vet the best health sharing companies. I highly recommend this “best kept secret”!

Colette M.

New York

"Thank you for creating an innovative and affordable service"

I’ve been able to schedule mental health appointments and get immediate primary care as needed, along with affordable prescriptions. It’s great for someone like me who generally goes to the doctor a few times a year. What I enjoy, but didn’t realize at the time, was the concierge aspect of the service. I don’t have to call around – your team does that for me to ensure a provider is in the network! So no surprise bills. It’s great- thank you for creating an innovative and affordable service.

Cierra

Texas

"indipop offers me comprehensive health care at a fraction of the cost"

Indipop offers me comprehensive health care at a fraction of the cost of my previous ACA plan with more coverage. Even before I signed up, indipop stepped in to assist with finding me affordable options for a very costly procedure.

Beth L.

Small Business

"indipop empowers our patients to get the best care"

Indipop empowers our patients to get the best care and as a medical practice we find the billing process to be efficient or even faster.

NY Medical Practice

"We are saving hundreds of dollars per month"

We are saving hundreds of dollars per month. I have a valuable health care plan with staff that provides assistance almost immediately. I am very glad to have partnered with Indipop.

Halifax FibreNew

"They helped me pick the best plan for my family and employees"

indipop team were awesome to work with when I co-founded a start-up. The cost of the plans were very affordable with great coverage and benefits. They helped me pick the best plan for my family and employees. My son injured himself shortly after we signed up and the service level and responsiveness were fantastic. indipop took care of everything so we could focus on our son. I highly recommend indipop for start-ups, small businesses, independent contractors, and freelancers.

Brandon

California

"Best healthcare decision we ever made. Thanks indipop!"

As a father of 2 young kids, indipop plans have been a great fit for me and my family. The 24/7 telehealth has saved stress, time and money dealing with various health issues that always seem to pop up on the weekends, plus, we were able to keep our family doctor. Best healthcare decision we ever made. Thanks indipop!

Jamie

Arizona

"The services provided are extremely efficient, which saves me time and energy."

I have had the most spectacular experience with indipop. I am on the Re-direct healthcare plan. Every time I speak with a representative I get an upbeat, happy, and attentive employee. The services provided are extremely efficient, which saves me time and energy. The people who make up this company are the best people I have ever worked with! Everything is simple and everyone is so polite. I hope I never have to go back to hospital insurance. I am so incredibly impressed. The world needs to know how stress-free and easy dealing with medical insurance issues should be. I highly recommend everyone take a leap of faith and place your medical insurance needs in their hands. You will be blown away by the professionalism and efficiency.

McKenna O.

Arizona

"If you’re self-employed, a founder, or operating outside a corporate benefits structure, this is absolutely worth exploring."

As a business owner, health insurance has always felt like choosing between expensive and complicated or cheap and risky.

indipop was the first time it actually felt designed for how entrepreneurs live and work.

The process was clear, the education mattered, and I understood what I was buying instead of just picking a plan and hoping. The coverage fits the realities of running a business, changing income, and not having a traditional employer safety net.

It removed a lot of background stress I didn’t realize I was carrying.

Phil Gerard

"Wow!"

I’ve never experienced such great care and service in healthcare!

B.Davis

Arizona

"When we became self-employed, we switched from traditional insurance to indipop so we could keep our doctors without the high costs."

The service has been outstanding—every time I call, I get a quick, helpful response. Billing is smooth, our providers are happy, and there have been no surprises. It’s cost-effective, straightforward, and truly feels human.

Elena G.

"They gave us a tremendous amount of insight and time into a plan that worked for our family!"

They guided us through the process and supplied us with a lot of information in an organized way and presented it to us in a way that was not overwhelming.

We have already referred friends and family and will continue to do so going forward.

Shimon K.

"I’m thrilled with my experience using a healthshare through indipop."

After tearing my meniscus, I got fast access to a top surgeon in Vail—no insurance headaches, no delays. My care, including physical therapy and even rolfing, was fully supported. I paid my IUA, and everything else was covered. No surprises. This is how healthcare should be.

Colin V.

"So glad they reached out to me!"

Very easy working with them and super happy with my new insurance plan. I’m spending much much less per month and barely any out of pocket fees. Its just about a year now and I couldn’t be happier.

Sharon H.

"indipop is awesome!"

When I needed medical coverage they (Melissa) hooked me up with a great medical sharing company that has worked out wonderfully. I HIGHLY recommend Indipop!

Fibrenew Foothills

"indipop has been great!"

After switching from corporate to self-employed, they were a godsend in getting setup on an affordable plan. Couldn’t recommend them enough!

Rachel S.

"Wonderful company!"

Dedicated team – I couldn’t be happier!!!

David R.

"Would strongly recommend for anyone looking for a healthcare alternative"

They are much more helpful and easy to communicate with than any government healthcare service. Shoutout to Sierra for all your help!

Ravi

NY

"It’s the best financial and health move I have made ever"

With indipop’s help I switched from insurance to a healthshare and it’s the best financial and health move I have made ever. I only wish I knew about healthshares sooner. Thank you Melissa!

Amy B.

Self Employed | California

"The relief I feel is astounding"

I wanted to thank you from the bottom of my heart for the work that you do. I cannot express how stressed I have been about what I would do for health insurance once my COBRA coverage ended and the relief I feel is astounding.

Molly J.

Self Employed | New York

"I highly recommend this 'best kept secret'!"

Everyone suffers from the high costs of medical insurance and fighting for reimbursements if you go out of network.

Melissa discovered an alternative known by few and she did extensive research to vet the best health sharing companies. I highly recommend this “best kept secret”!

Colette M.

New York

"Thank you for creating an innovative and affordable service"

I’ve been able to schedule mental health appointments and get immediate primary care as needed, along with affordable prescriptions. It’s great for someone like me who generally goes to the doctor a few times a year. What I enjoy, but didn’t realize at the time, was the concierge aspect of the service. I don’t have to call around – your team does that for me to ensure a provider is in the network! So no surprise bills. It’s great- thank you for creating an innovative and affordable service.

Cierra

Texas

"indipop offers me comprehensive health care at a fraction of the cost"

Indipop offers me comprehensive health care at a fraction of the cost of my previous ACA plan with more coverage. Even before I signed up, indipop stepped in to assist with finding me affordable options for a very costly procedure.

Beth L.

Small Business

"indipop empowers our patients to get the best care"

Indipop empowers our patients to get the best care and as a medical practice we find the billing process to be efficient or even faster.

NY Medical Practice

"We are saving hundreds of dollars per month"

We are saving hundreds of dollars per month. I have a valuable health care plan with staff that provides assistance almost immediately. I am very glad to have partnered with Indipop.

Halifax FibreNew

"They helped me pick the best plan for my family and employees"

indipop team were awesome to work with when I co-founded a start-up. The cost of the plans were very affordable with great coverage and benefits. They helped me pick the best plan for my family and employees. My son injured himself shortly after we signed up and the service level and responsiveness were fantastic. indipop took care of everything so we could focus on our son. I highly recommend indipop for start-ups, small businesses, independent contractors, and freelancers.

Brandon

California

"Best healthcare decision we ever made. Thanks indipop!"

As a father of 2 young kids, indipop plans have been a great fit for me and my family. The 24/7 telehealth has saved stress, time and money dealing with various health issues that always seem to pop up on the weekends, plus, we were able to keep our family doctor. Best healthcare decision we ever made. Thanks indipop!

Jamie

Arizona

"The services provided are extremely efficient, which saves me time and energy."

I have had the most spectacular experience with indipop. I am on the Re-direct healthcare plan. Every time I speak with a representative I get an upbeat, happy, and attentive employee. The services provided are extremely efficient, which saves me time and energy. The people who make up this company are the best people I have ever worked with! Everything is simple and everyone is so polite. I hope I never have to go back to hospital insurance. I am so incredibly impressed. The world needs to know how stress-free and easy dealing with medical insurance issues should be. I highly recommend everyone take a leap of faith and place your medical insurance needs in their hands. You will be blown away by the professionalism and efficiency.

McKenna O.

Arizona

"Game changer services."

I am so grateful to have discovered Indipop! It’s been a game changer for me and my family, saving us hundreds of dollars every month on healthcare. The team is so helpful and quick to respond, and most importantly they genuinely care

Y & M.

Arizona

"They gave me the best options for protifable health membership options."

I took a leap of faith when my Premera insurance skyrocketed and I knew there had to be another solution. Hello indipop! This has been a game changer! Melissa at Indipop guided me to the right solution as she educates people regarding health membership models and matches you with the best fit. Healthcare is always an unknown. It’s been 4 years now, and I have to say I’m impressed with the level of service and doctors. My costs are far lower and I never worry who I want to see. There really is an answer to traditional insurance. This is it!

A. M.

Arizona

You might be wondering…

The good news: No. And look, we get it. With 20-70% savings, high value, and affordable out of pocket, you’re probably expecting some strings attached. But indipop is pretty picky about who makes the cut.

Explore the options Compare Plans

Yes, the healthcare memberships are not PPO’s or HMO’s. So you’re free to choose a provider or keep the one you have.

Healthcare is a massive system, but you don’t have to navigate it alone. Medical advocates and concierge teams are here to guide you through every step—helping you understand treatment options, coordinate appointments, and manage bills. They provide personalized support and work to secure fair, transparent pricing, so you’re never surprised by unexpected medical costs.

Explore The Latest

Quick Links

About Us

More