indipop Essential + HSA

Powered by Zion Healthshare

Navigating the healthcare system doesn’t have to be a headache. All indipop plans include a level of service that most of our members have never known possible before indipop.

Solopreneurs, 1099’s and Small Businesses are eligible

Eligibility Requirements

- 1099 or Employer Identification Number (EIN)

- You cannot be claimed as a dependent on another person’s tax return (unless it’s your spouse) and must not have any other health coverage

- Individuals, families and groups may join this option

Explore our partnership with TrueMed for assistance with HSA services and information for HSA eligible products.

This membership is not available in Washington or North Dakota

Be advised if you live in California, New Jersey, Vermont, the District of Columbia, Massachusetts or Rhode Island, you may be subject to tax penalty, we suggest speaking with your financial planner or accountant prior to joining.

Why people love the Essential + HSA:

- Triple tax advantaged Health Saving Account

- Freedom and flexibility to pay for eligible medical expenses traditional insurance plans may not cover

- Boost your savings by using the concierge to get discounted rates

- Keep what you don’t spend and roll over to the following year

What's Included?

Preventive Care / Annual Wellness

ACA (Affordable Care Act) compliant preventive care services including:

- Annual Wellness Visit

- Well-Woman Visit

- Childhood Immunizations

- Mammograms

- Colonoscopies

Primary Care & Specialists

- Choose your provider or let the concierge team locate one for you

- Take advantage of the discounted, cash pay rate and present as a “self pay” patient

- Pay for in person primary care and specialist visits at the cash pay rate with your tax deductible, HSA contributions

Virtual Care

This membership provides access to primary care, pediatric, women’s health, specialists and behavioral health board-certified physicians on your own time, whenever and wherever.

Mental Health

LifeCare

Member Assistance Program

100% Confidential Counseling: This program provides members with a way to find help dealing with personal and work-related issues.

Services include:

Counseling: $0 virtual or telephonic sessions with a counselor

Psychology: $100/session, virtual or telephonic visits with a licensed psychologist

Psychiatry: $200 intake session, then $100/session virtual or telephonic visits with a licensed psychiatrist who can order non-controlled medications.

Dermatology

3 virtual visits included for $0 per household per membership year

Pet Telehealth

Complementary telehealth sessions with a vet to answer simple questions for non-emergency situations

Imaging and Labs

ACA-compliant preventive labs and screenings included per the ACA for $0.

Diagnostic Imaging and Labwork

- For non-emergency needs, the virtual care providers can order the imaging and labs you need.

- Pay the discounted, self-pay rate with the assistance of the concierge who will cost and quality shop for services near you.

If the cost of these diagnostic services becomes part of a larger medical need, they will count toward your IUA.

Large Medical Needs

Emergency Room and Urgent Care

- Capped at your chosen IUA.

- Present as self pay and pay the cash pay rate. If this turns into a large medical need, the cost of that visit will apply toward your IUA.

Maternity

Expectant mothers pay a single IUA for all expenses related to their eligible maternity sharing request. Expenses eligible for sharing include those related to miscarriage, prenatal care, postnatal care, and delivery.

Pregnancy existing prior to membership is not shareable. The conception date will be confirmed by medical records.

*please ask about limitations

Open Network

For in-person primary care, specialists, urgent care and diagnostics, the concierge will direct you to a cash pay provider or, keep your provider, present as a self pay patient and pay the cash pay rate.

Cost & Quality Search Assistance

The Concierge Team researches the highest quality, fairest priced providers, diagnostics centers, labs, and medical facilities for members who are in need of these services.

RX

Find the most affordable price for your prescriptions needs through the CitizenRx discount formulary.

Health Savings Account Compatible

HSA compatible for triple tax-advantaged medical savings to be used to pay for qualified medical expenses with your tax-deductible contributions.

- In 2026, an individual can contribute up to $4,400 and a family can contribute up to $8,750 tax-deductible to their HSA.

- Growth on interest or investment is tax deductible

- Keep what you don’t use and roll the balance over to the following year in addition to your annual contribution

- Over the age of 55? See if you qualify for catch-up contributions

- See if the 1-month rule applies to you

- After age 65, HSA funds can be rolled into a retirement account

Pre-Membership

This membership limits sharing for pre-membership conditions.

The existence of a premembership condition does not prevent participation in the membership and is not intended to deny care.

If you or someone in your membership has a premembership condition, sharing for that condition will not be shareable in the first year of membership.

Thereafter, sharing for premembership conditions that are otherwise eligible for sharing will increase based on the member’s tenure as follows:

- 2nd year: $25,000

- 3rd year: $50,000

- 4th year: $125,000*

A pre-membership medical condition is any illness or injury for which a person has been:

- Examined

- Diagnosed

- taken medication

- had symptoms or,

- has a personal history of or known increased risk of conditions that may arise or worsen in pregnancy

or - received medical treatment within the 24 months prior to their membership start date.

Exclusions: High blood pressure, high cholesterol, and diabetes are not considered pre-membership medical conditions as long as the member has not been hospitalized for the condition in the 24 months prior to joining, and the member is able to control the condition through medication or diet and exercise.

Please note: pre-membership medical conditions may still qualify for sharing through the Additional Giving fund.

If you think you have a pre-membership condition, reach out to a member of our team to discuss the applicability of this provision.

Essential + HSA

Routine services are available without needing to meet your IUA first. Once your IUA is met (up to three times per year), there’s no additional coinsurance—the community shares the rest.

Important: Always review pre-membership medical condition guidelines before enrolling.

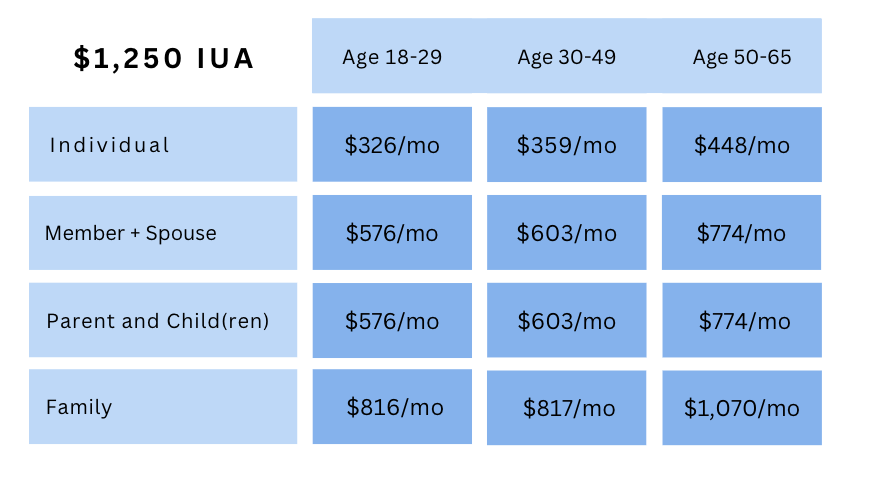

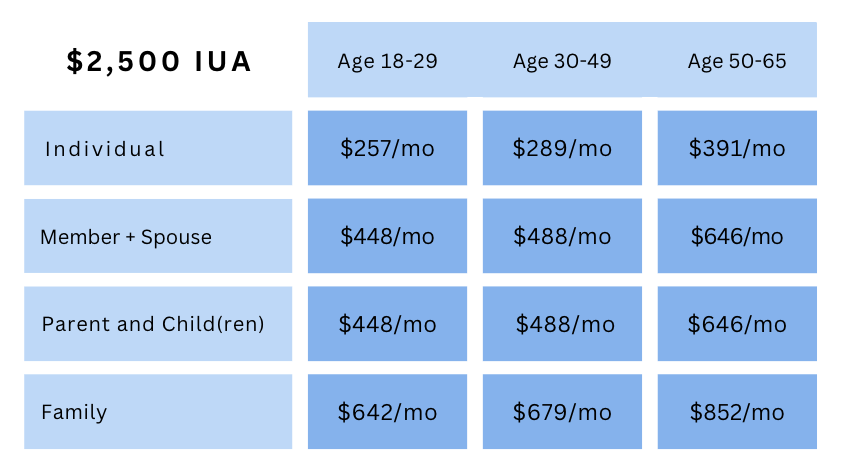

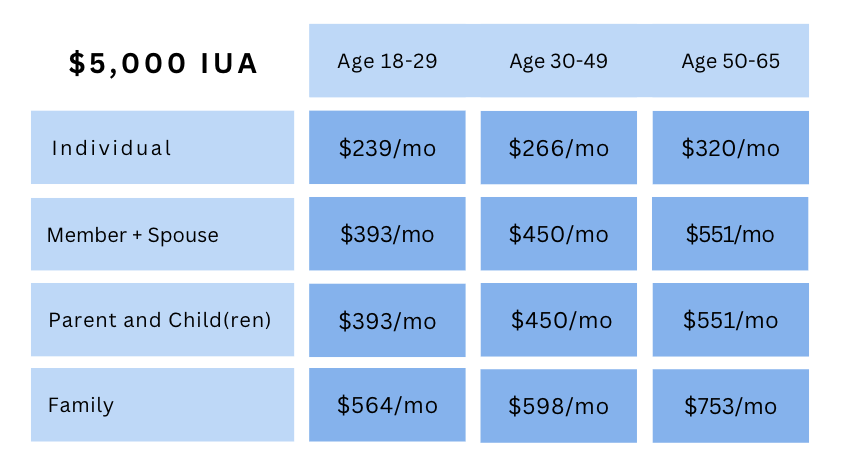

Select the IUA (cap on high-cost medical expenses) *rates active 2026

Similar Options

Similar Options

indipop Essential + HSA FAQ

- What's an IUA?

- Are indipop plans insurance?

- Is there a network?

- Dental + Vision and Prescription

An IUA, or initial unshareable amount, is your member responsibility for expenses related to a single eligible Medical Need. Designed to avoid costly surprise medical bills, IUAs function as caps on your out of pocket costs for eligible medical needs. You are responsible for a maximum of 3 IUA’s in a 12 month period. For many of our memberships, you have the freedom to select your IUA.

No. These month to month memberships and plans offer an alternative approach to paying for and accessing healthcare. Each membership included in our marketplace was carefully selected to meet indipop’s strict criteria. Registration for Group Plans and Individual or Family memberships is available year round – some with a same day effective date. Simply structured to provide set, transparent pricing and designed to avoid surprise medical bills – see if you are a good fit for one of our memberships.

Why choose indipop

All of our memberships feature:

- Large or open nationwide networks

- Set, transparent pricing

- No lifetime or annual caps

- Open enrollment all year long

- Portability in all 49 states and when traveling abroad

- Concierge service and medical advocates

Are indipop plans insurance?This membership does not restrict you to a network. Receive identical services in all 50 states with the doctor of your choice. As we like to say here at indipop, you have the freedom to choose who cares for you!

Unlike traditional HMO or PPO plans, these memberships provide medical advocacy teams to help coordinate your care. Need help finding a doctor? The concierge will connect you with a provider wherever you go.

The more you involve the team, the closer you'll be to zero medical bills.

Add these supplements to any plan

indipop dental and vision

Vision, dental and prescription discounts

After you cross healthcare off your list, check out our partners, they can help with offers for credit card processing to cybersecurity.

Zion HealthShare is not an insurance company. Neither this publication nor membership in Zion HealthShare are offered by an insurance company. Visit zionhealthshare.org to view your state specific notice.

See Why People Love indipop

Posted onTrustindex verifies that the original source of the review is Google. As a business owner, health insurance has always felt like choosing between expensive and complicated or cheap and risky. indipop was the first time it actually felt designed for how entrepreneurs live and work. The process was clear, the education mattered, and I understood what I was buying instead of just picking a plan and hoping. The coverage fits the realities of running a business, changing income, and not having a traditional employer safety net. It removed a lot of background stress I didn’t realize I was carrying. If you’re self-employed, a founder, or operating outside a corporate benefits structure, this is absolutely worth exploring.Posted onTrustindex verifies that the original source of the review is Google. Indipop was the perfect solution for us when we lost access to employer-sponsored health plans, and Sierra in particular was responsive, helpful, and great to work with!Posted onTrustindex verifies that the original source of the review is Google. I am so grateful to have discovered Indipop! It's been a game changer for me and my family, saving us hundreds of dollars every month on healthcare. The team is so helpful and quick to respond, and most importantly they genuinely care.Posted onTrustindex verifies that the original source of the review is Google. I took a leap of faith when my Premera insurance skyrocketed and I knew there had to be another solution. Hello indipop! This has been a game changer! Melissa at Indipop guided me to the right solution as she educates people regarding health membership models and matches you with the best fit. Healthcare is always an unknown. It's been 4 years now, and I have to say I'm impressed with the level of service and doctors. My costs are far lower and I never worry who I want to see. There really is an answer to traditional insurance. This is it!Posted onTrustindex verifies that the original source of the review is Google. Discovering Indipop has been a game-changer for me. As an entrepreneur, navigating the complex waters of healthcare has always felt like an uphill battle. That was until I was introduced to Indipop. Their concierge support and personalized guidance have been invaluable, making healthcare simple and accessible. Indipop’s dedication to quality and transparency is not only refreshing but deeply appreciated. Here's to a healthier future with Indipop by my side!Posted onTrustindex verifies that the original source of the review is Google. indipop offers the best healthcare plans for the self-employed. The team was helpful before and after onboarding; they just want the best for you. As long as I am self-employed or owning my business, indipop will be my healthcare solution!Posted onTrustindex verifies that the original source of the review is Google. I love redirect health- it’s an excellent healthcare option!!!Posted onTrustindex verifies that the original source of the review is Google. Rachelle was amazing. Very friendly and informative. She just wants to get her clients the right coverage. I highly recommend her.Posted onTrustindex verifies that the original source of the review is Google. Indipop has been great! After switching from corporate to self-employed, they were a godsend in getting setup on an affordable plan. Couldn't recommend them enough!Posted onTrustindex verifies that the original source of the review is Google. Wonderful company! Dedicated team - I couldn’t be happier!!!