indipop Core

Navigating the healthcare system doesn’t have to be a headache. All indipop plans include a level of service that most of our members have never known possible before indipop.

Why people love Core:

- Sharing for maternity needs in the first year*

- Total freedom from the traditional system

Things to consider:

- 36-month look back period

- 6-month waiting period for preventive screenings.

- Reimbursement model

*Not available in WA, VT, ND, PA, NM, CA, MD, MT and FL

What's Included?

Preventive Care

Age appropriate screenings are available after 6 months of continuous membership and reimbursed based on guideline allowance.

Virtual Care

- Optional add-on service

- Unlimited access to physicians

- Virtual care at your fingertips

Primary Care

To see a primary care provider simply ask for the “self-pay” or “cash pay” rate to take advantage of the discounted rate, or use the Savvos cash pay marketplace to locate low-cost providers and services near you. If the need becomes larger, your payment will apply to your chosen IUA.

Specialists

To see a specialist care provider simply ask for the “self-pay” or “cash pay” rate to take advantage of the discounted rate, or use the Savvos cash pay marketplace to locate low-cost providers and services near you. If the need becomes larger, your payment will apply to your chosen IUA.

Imaging and Labs

Use the Savvos cash pay marketplace to locate low-cost services near you. If the need becomes larger, your payment will apply to your chosen IUA.

E.R./Urgent Care

Urgent Care

Use the Savvos cash pay marketplace to locate low-cost providers and services near you.

If the need becomes larger, your payment will apply to your chosen IUA.

Emergency Room

Capped at the chosen IUA for expenses related to a single eligible medical need.

High Cost Medical

Expenses related to eligible medical needs are capped at your chosen IUA (initial unshareable amount) or member responsibility.

You are responsible for no more than 3 in a 12 month period per membership. Choose between a $500, $1000, $1500, $2500 or $5000 IUA.

Example: If you choose the $1,000 IUA and you break your leg and need surgery, medical expenses total $10,000. Your cost for this medical need is capped at $1,000 – including follow-up care, provider visits, and physical therapy, if necessary.

TIP: If you select the $5,000 IUA, you may be saving monthly, but if your family has 3 major medical needs in a year, you could be responsible for $15,000 ($5000 X 3) out of pocket.

RX

- Save up to 80% on medications

- Powerful shopping tool for comparing Rx prices

- Over 67,000 pharmacies

Savvos Cash Pay Marketplace

- Shop for imaging, outpatient surgery, labs, diagnostics & more

- Save up to 90% compared to local hospitals

- Simplified communication, approvals, scheduling & payment

- And, enjoy a reduced IUA for utilizing Savvos

Member Support

- Real live experts

- Assist with sharing questions

- Guide you every step of the way

Membership Concierge

- Service to help Members find cash pay providers in their area and value driven pricing for care

- Recommendations within 3-5 days

Maternity

Maternity Specific Initial Unshareable Amount applies:

2x the Member’s selected IUA up to a maximum of $5,000.

Newborn Members must be added to a household no later than 30 days after birth to be eligible for shared funds.

*Existing pregnancy will be treated as a pre-existing condition

Pre-Membership

This membership limits sharing for pre-membership conditions.

The existence of a pre-membership condition does not prevent participation in the membership and is not intended to deny care. If you or someone in your membership has a pre-membership condition, sharing for that condition will not be shareable in the first year of membership.

Thereafter, sharing for pre-membership conditions for which symptoms and/or treatment existed within 36 months prior to membership.

Year 1: No cost sharing for the condition

Year 2: A $25,000 sharing limit for condition

Year 3: A $50,000 sharing limit for condition

Year 4: Condition eligible for full sharing

A pre-membership medical condition is any illness or injury for which a person has been:

- Examined

- Diagnosed

- Taken medication

- Had symptoms or,

- Has a personal history of or known increased risk of conditions that may arise or worsen in pregnancy or

- Received medical treatment within the 36 months prior to their membership start date.

Exclusions: Back pain, genetic defects, high blood pressure, diabetes not requiring insulin and heart conditions are not considered pre-membership medical conditions as long as the member has not been hospitalized for the condition in the 36 months prior to joining, the member is able to control the condition through medication or diet and exercise, and a written verification signed by both the Member and the Member’s treating physician must be submitted to substantiate that there have been no signs or symptoms of the condition, no treatment needed, no medication recommended or taken, and no suspicion by the patient or doctors that the condition was resurfacing for at least 36 months prior to membership Start Date.

If you think you have a premembership condition, reach out to a member of our team to discuss the applicability of this provision.

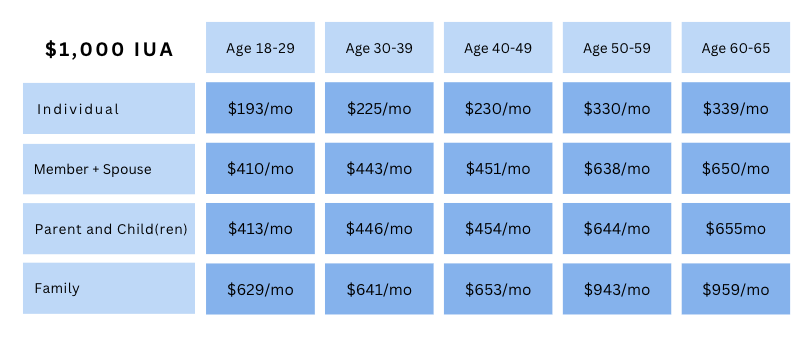

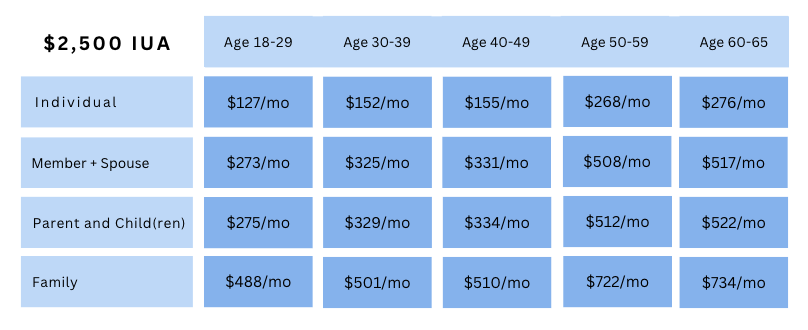

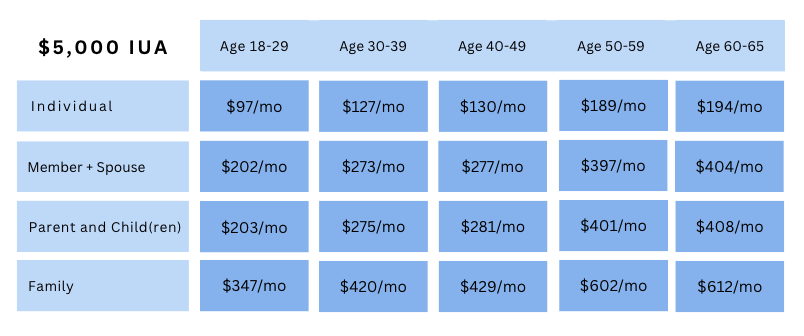

indipop Core Rates

Routine services are available without needing to meet your IUA first. Once your IUA is met (up to three times per year), there’s no additional coinsurance—the community shares the rest.

Important: Always review pre-membership medical condition guidelines before enrolling.

Select the IUA (cap on high-cost medical expenses)

Similar Options

Similar Options

indipop Core FAQ

- What's an IUA?

- Are indipop plans insurance?

- Is there a network?

- Dental + Vision and Prescription

An IUA, or initial unshareable amount, is your member responsibility for expenses related to a single eligible Medical Need. Designed to avoid costly surprise medical bills, IUAs function as caps on your out of pocket costs for eligible medical needs. You are responsible for a maximum of 3 IUA’s in a 12 month period. For many of our memberships, you have the freedom to select your IUA.

No. These month to month memberships and plans offer an alternative approach to paying for and accessing healthcare. Each membership included in our marketplace was carefully selected to meet indipop’s strict criteria. Registration for Group Plans and Individual or Family memberships is available year round – some with a same day effective date. Simply structured to provide set, transparent pricing and designed to avoid surprise medical bills – see if you are a good fit for one of our memberships.

Why choose indipop

All of our memberships feature:

- Large or open nationwide networks

- Set, transparent pricing

- No lifetime or annual caps

- Open enrollment all year long

- Portability in all 49 states and when traveling abroad

- Concierge service and medical advocates

These memberships do not restrict you to a network. Receive identical services in all 50 states with the doctor of your choice. As we like to say here at indipop, you have the freedom to choose who cares for you!

Unlike traditional HMO or PPO plans, these memberships provide medical advocacy teams to help coordinate your care. Need help finding a doctor? The concierge will connect you with a provider wherever you go.

The more you involve the team, the closer you'll be to zero medical bills.

Add these supplements to any plan

indipop dental and vision

Vision, dental and prescription discounts

After you cross healthcare off your list, check out our partners, they can help with offers for credit card processing to cybersecurity.

See Why People Love indipop

Posted onTrustindex verifies that the original source of the review is Google. I am so grateful to have discovered Indipop! It's been a game changer for me and my family, saving us hundreds of dollars every month on healthcare. The team is so helpful and quick to respond, and most importantly they genuinely care.Posted onTrustindex verifies that the original source of the review is Google. I took a leap of faith when my Premera insurance skyrocketed and I knew there had to be another solution. Hello indipop! This has been a game changer! Melissa at Indipop guided me to the right solution as she educates people regarding health membership models and matches you with the best fit. Healthcare is always an unknown. It's been 4 years now, and I have to say I'm impressed with the level of service and doctors. My costs are far lower and I never worry who I want to see. There really is an answer to traditional insurance. This is it!Posted onTrustindex verifies that the original source of the review is Google. Discovering Indipop has been a game-changer for me. As an entrepreneur, navigating the complex waters of healthcare has always felt like an uphill battle. That was until I was introduced to Indipop. Their concierge support and personalized guidance have been invaluable, making healthcare simple and accessible. Indipop’s dedication to quality and transparency is not only refreshing but deeply appreciated. Here's to a healthier future with Indipop by my side!Posted onTrustindex verifies that the original source of the review is Google. indipop offers the best healthcare plans for the self-employed. The team was helpful before and after onboarding; they just want the best for you. As long as I am self-employed or owning my business, indipop will be my healthcare solution!Posted onTrustindex verifies that the original source of the review is Google. I love redirect health- it’s an excellent healthcare option!!!Posted onTrustindex verifies that the original source of the review is Google. Rachelle was amazing. Very friendly and informative. She just wants to get her clients the right coverage. I highly recommend her.Posted onTrustindex verifies that the original source of the review is Google. Indipop has been great! After switching from corporate to self-employed, they were a godsend in getting setup on an affordable plan. Couldn't recommend them enough!Posted onTrustindex verifies that the original source of the review is Google. Wonderful company! Dedicated team - I couldn’t be happier!!!Posted onTrustindex verifies that the original source of the review is Google. We shifted our family from traditional insurance to Indipop Health share when we became self-employed. It was important for us to maintain our current doctors and clinics. Indipop provided the coverage we needed without the expense of traditional insurance. The greatest advantage of the Indipop program is the individual service and attention. Each time I call, I am quickly connected to a knowledgeable staff person who is able to handle my request. Nothing is ever a "problem." They never fail to call back, should the answer not be immediate. While it takes some adjustment to learn the new procedure (or, un-learn traditional insurance), the staff is exceptional at guiding me. Additionally, our doctors' offices have been delighted to work with Indipop's staff on billing, which is always handled very quickly. I truly believe that Indipop and the health share-style medical coverage program is the wave of the future. It is straight-forward, cost-effective, human-powered, and realistic. There have been no unforeseen surprises or expenses. Everything has been within the parameters given when we signed-up.Posted onTrustindex verifies that the original source of the review is Google. Rachelle and Mellisa at Indipop were absolutely amazing. They gave us a tremendous amount of insight and time into a plan that worked for our family! They guided us through the process and supplied us with a lot of information in an organized way and presented it to us in a way that was not overwhelming. We have already referred friends and family and will continue to do so going forward. Thank you!