indipop Basic

Powered by Zion Healthshare

Navigating the healthcare system doesn’t have to be a headache. All indipop plans include a level of service that most of our members have never known possible before indipop.

Same day membership, start any day of the month!

Ask about our supplemental plans to customize your healthcare to suit your specific needs.

This option is not available in MA, MD, MT, WA, or PA

Be advised if you live in California, New Jersey, Vermont, the District of Columbia, Massachusetts or Rhode Island, you may be subject to tax penalty, we suggest speaking with your financial planner or accountant prior to joining.

Why people love the Basic:

- Affordable monthly and out of pocket cost

- Preventive care and virtual health and Rx included

- Set transparent rates for unexpected, acute medical needs

What's Included?

Preventive Care / Annual Wellness

A yearly wellness check and age appropriate screenings.

- Colonoscopies age 45

- Mammograms age 40

- Child Immunizations

*6 month waiting period for screenings

Primary Care & Specialists

This membership does not restrict you to networks. If you wish to keep your provider, simply ask for the “self-pay” or “cash pay” rate to take advantage of the discount or ask the Medical Advocacy Team to locate a cash pay friendly provider near you.

Virtual Care

Unlimited virtual visits 24/7 with no consultation fee. Skip the wait at the doctor’s office and get care from home.

Mental Health

The Basic membership provides a platform for unlimited access to mental health resources to include: therapeutic resources, workshops/classes and self guided therapy.

For an additional $50 per month, receive 2 virtual visits per member, per month with unlimited texting and calling with a therapist for three months.

After 3 months, you may continue your virtual visits for $200 per month for 2 virtual visits per member, per month with unlimited texting and calling with your therapist.

Imaging and Labs

Imaging and Labwork

- For non-emergency needs, the virtual care providers can order the imaging and labs you need.

- Pay the discounted, self-pay rate with the assistance of the concierge who will cost and quality shop for services near you.

If the cost of these diagnostic services becomes part of a larger medical need, they will count toward your IUA.

High Cost Medical Needs

E.R. and Urgent Care

Emergency Room

Capped at the chosen IUA for expenses related to an eligible medical need.

Urgent Care

Self-pay. If this turns into a large medical need, that out-of-pocket cost is applied to your IUA.

Maternity

Expectant mothers pay a single IUA for all expenses related to an eligible maternity sharing request.

Conception must occur after six months of continuous membership.

Pregnancy existing prior to membership is not shareable.

Expenses eligible for sharing include those related to miscarriage, prenatal care, postnatal care, and delivery.

The conception date will be confirmed by medical records.

*Please ask about limitations

Open Network

You are not restricted to networks. If you wish to keep your provider, simply ask for the “self-pay” or “cash pay” rate to take advantage of the discount or ask the Medical Advocacy Team to locate a cash pay friendly provider near you.

Even when traveling, contact medical advocacy for help finding a provider and services where you are.

RX

Included with your Basic membership is:

- Access to discounted prescription medications, with hundreds of medications at up to 80% off retail prices

- Low-cost generics

- $0 member responsibility on 37 acute medications

- 800+ maintenance medications available at just $5.

- A $150 member benefit credit is applicable to both Tier 1b generic medications and Tier 2 preferred brands and Tier 3 non-preferred brands and

- A prescription assistance program for help with high-cost medications.

- With mail order service

- Conveniently order online or by phone

Membership Team

A dedicated medical advocacy team will help you coordinate your healthcare so you receive the best possible care.

When an in-person visit is necessary, reach out to Medical Advocacy first for navigation and assistance finding high quality, fair price providers.

Need help with an upcoming procedure? Medical Advocacy will help you get good faith estimates, provide prepayment assistance and, if necessary, surgical procedure coordination.

Pharmacy Benefit

Do you need a high cost medication? Medical Advocacy will search FDA approved pharmacies abroad or identify prescription assistance programs like manufacturer’s coupons to ease the burden for members out of pocket costs for prescriptions.

Alternative Care

Alternative Care Treatment –Alternative medical treatments can be shared with the Medical Cost Sharing community. These alternatives generally should be considered safe and effective while being an alternative to a traditional treatment plan. Needs may be considered shareable pending prior written approval by your Medical Cost Sharing provider. Member is required to demonstrate the proposed value of the alternative treatment.

Pre-Membership

This membership limits sharing for premembership conditions.

The existence of a premembership condition does not prevent participation in the membership and is not intended to deny care. If you or someone in your membership has a premembership condition, sharing for that condition will not be shareable in the first year of membership.

Thereafter, sharing for premembership conditions that are otherwise eligible for sharing will increase based on the members tenure as follows:

- 2nd year: $25,000

- 3rd year: $50,000

- 4th year: $125,000*

A pre-membership medical condition is any illness or injury for which a person has been:

- Examined

- Diagnosed

- Taken medication

- Had symptoms or,

- Has a personal history of or known increased risk of conditions that may arise or worsen in pregnancy or

- Received medical treatment within the 24 months prior to their membership start date.

Exclusions: High blood pressure, high cholesterol, diabetes, are not considered pre-membership medical conditions as long as the member has not been hospitalized for the condition in the 24 months prior to joining, and the member is able to control the condition through medication or diet and exercise.

Please Note: pre-membership medical conditions may still qualify for sharing through the Additional Giving fund.

If you think you have a premembership condition, reach out to a member of our team to discuss the applicability of this provision.

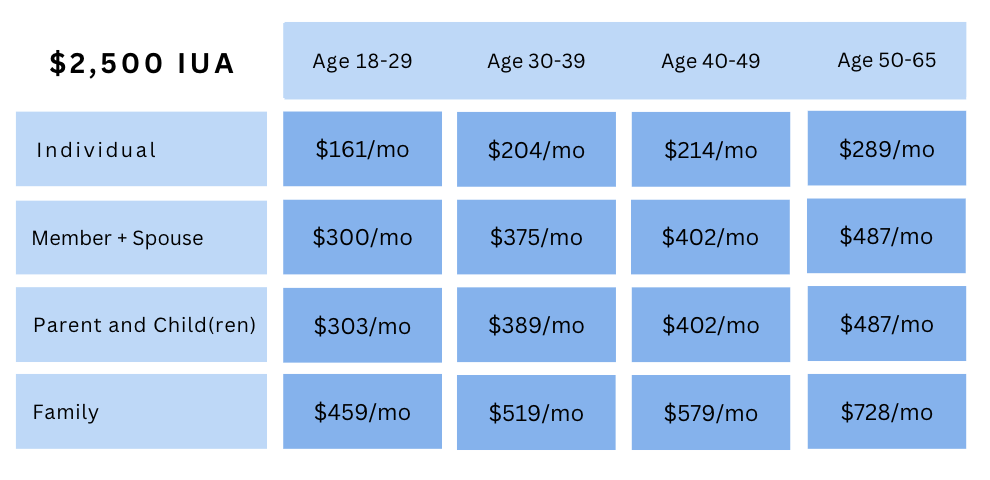

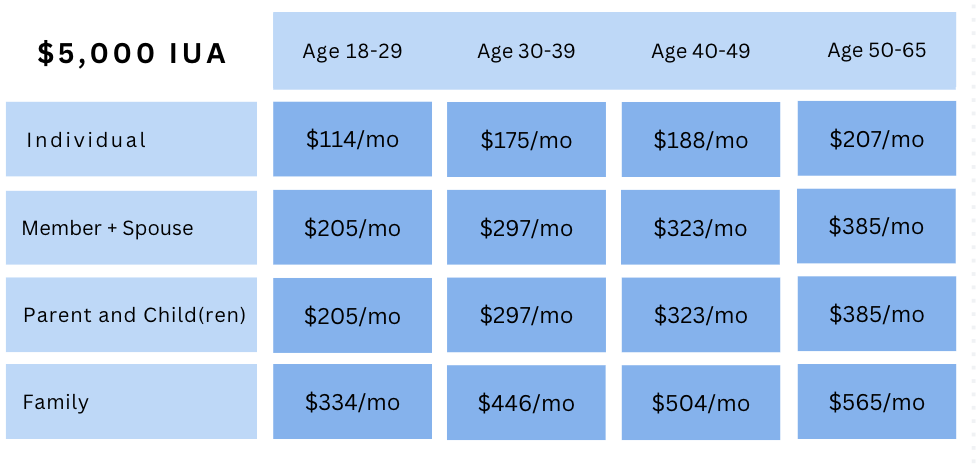

Basic Rates

Routine services are available without needing to meet your IUA first. Once your IUA is met (up to three times per year), there’s no additional coinsurance—the community shares the rest.

Important: Always review pre-membership medical condition guidelines before enrolling.

Select the IUA (cap on high-cost medical expenses)

Select the IUA $1,000 or $2,500 (cap on high-cost medical expenses)

Similar Options

Similar Options

indipop Basic FAQ

- What's an IUA?

- Are indipop plans insurance?

- Is there a network?

- Dental + Vision and Prescription

An IUA, or initial unshareable amount, is your member responsibility for expenses related to a single eligible Medical Need. Designed to avoid costly surprise medical bills, IUAs function as caps on your out of pocket costs for eligible medical needs. You are responsible for a maximum of 3 IUA’s in a 12 month period. For many of our memberships, you have the freedom to select your IUA.

No. These month to month memberships and plans offer an alternative approach to paying for and accessing healthcare. Each membership included in our marketplace was carefully selected to meet indipop’s strict criteria. Registration for Group Plans and Individual or Family memberships is available year round – some with a same day effective date. Simply structured to provide set, transparent pricing and designed to avoid surprise medical bills – see if you are a good fit for one of our memberships.

Why choose indipop

All of our memberships feature:

- Large or open nationwide networks

- Set, transparent pricing

- No lifetime or annual caps

- Open enrollment all year long

- Portability in all 49 states and when traveling abroad

- Concierge service and medical advocates

These memberships do not restrict you to a network. Receive identical services in all 50 states with the doctor of your choice. As we like to say here at indipop, you have the freedom to choose who cares for you!

Unlike traditional HMO or PPO plans, these memberships provide medical advocacy teams to help coordinate your care. Need help finding a doctor? The concierge will connect you with a provider wherever you go.

The more you involve the team, the closer you'll be to zero medical bills.

Add these supplements to any plan

indipop dental and vision

Vision, dental and prescription discounts

After you cross healthcare off your list, check out our partners, they can help with offers for credit card processing to cybersecurity.

Zion HealthShare is not an insurance company. Neither this publication nor membership in Zion HealthShare are offered by an insurance company. Visit zionhealthshare.org to view your state specific notice.

See Why People Love indipop

Posted onTrustindex verifies that the original source of the review is Google. I am so grateful to have discovered Indipop! It's been a game changer for me and my family, saving us hundreds of dollars every month on healthcare. The team is so helpful and quick to respond, and most importantly they genuinely care.Posted onTrustindex verifies that the original source of the review is Google. I took a leap of faith when my Premera insurance skyrocketed and I knew there had to be another solution. Hello indipop! This has been a game changer! Melissa at Indipop guided me to the right solution as she educates people regarding health membership models and matches you with the best fit. Healthcare is always an unknown. It's been 4 years now, and I have to say I'm impressed with the level of service and doctors. My costs are far lower and I never worry who I want to see. There really is an answer to traditional insurance. This is it!Posted onTrustindex verifies that the original source of the review is Google. Discovering Indipop has been a game-changer for me. As an entrepreneur, navigating the complex waters of healthcare has always felt like an uphill battle. That was until I was introduced to Indipop. Their concierge support and personalized guidance have been invaluable, making healthcare simple and accessible. Indipop’s dedication to quality and transparency is not only refreshing but deeply appreciated. Here's to a healthier future with Indipop by my side!Posted onTrustindex verifies that the original source of the review is Google. indipop offers the best healthcare plans for the self-employed. The team was helpful before and after onboarding; they just want the best for you. As long as I am self-employed or owning my business, indipop will be my healthcare solution!Posted onTrustindex verifies that the original source of the review is Google. I love redirect health- it’s an excellent healthcare option!!!Posted onTrustindex verifies that the original source of the review is Google. Rachelle was amazing. Very friendly and informative. She just wants to get her clients the right coverage. I highly recommend her.Posted onTrustindex verifies that the original source of the review is Google. Indipop has been great! After switching from corporate to self-employed, they were a godsend in getting setup on an affordable plan. Couldn't recommend them enough!Posted onTrustindex verifies that the original source of the review is Google. Wonderful company! Dedicated team - I couldn’t be happier!!!Posted onTrustindex verifies that the original source of the review is Google. We shifted our family from traditional insurance to Indipop Health share when we became self-employed. It was important for us to maintain our current doctors and clinics. Indipop provided the coverage we needed without the expense of traditional insurance. The greatest advantage of the Indipop program is the individual service and attention. Each time I call, I am quickly connected to a knowledgeable staff person who is able to handle my request. Nothing is ever a "problem." They never fail to call back, should the answer not be immediate. While it takes some adjustment to learn the new procedure (or, un-learn traditional insurance), the staff is exceptional at guiding me. Additionally, our doctors' offices have been delighted to work with Indipop's staff on billing, which is always handled very quickly. I truly believe that Indipop and the health share-style medical coverage program is the wave of the future. It is straight-forward, cost-effective, human-powered, and realistic. There have been no unforeseen surprises or expenses. Everything has been within the parameters given when we signed-up.Posted onTrustindex verifies that the original source of the review is Google. Rachelle and Mellisa at Indipop were absolutely amazing. They gave us a tremendous amount of insight and time into a plan that worked for our family! They guided us through the process and supplied us with a lot of information in an organized way and presented it to us in a way that was not overwhelming. We have already referred friends and family and will continue to do so going forward. Thank you!